who claims child on taxes with 50/50 custody georgia

The largest child care tax credit a parent can claim is 600. Mom and Dad share joint 5050 custody and.

Child Custody Statistics What Custodial Parents Should Know

However if the child custody agreement is 5050 the IRS allows the parent with the highest income to claim the dependent deduction.

. The answer to this common question during a custody arrangement can. Who Claims the Child With 5050 Parenting Time. Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes.

Shared custody can create a situation where one parent gets to claim the child as a dependent. But divorced parents and those who arent married face a challenge. Solving your legal problems and putting your needs first are priorities for the Denver child custody lawyers.

If parents have 5050 parenting time but one parent contributes significantly more financials that parent may get to claim the child ren a greater percentage for example 2 out of 3 years. The amount for Childs Fitness and Arts. He says his lawyer told him he gets.

Who Claims a Child on US Taxes With 5050 Custody. Another thing that divorced or separated parents have to consider is who claims child on taxes with 5050 custody. For a confidential consultation with an experienced child custody lawyer in Dallas.

This seems straightforward enough but of course there are. Parents Can Decide Who Will Claim a Child on Tax Returns. In the joint custody case both parents have the right to claim this amount.

The parent with whom the child lived the longest - sometimes a nominal 5050 custody arrangement for educational purposes has the child staying with one parent marginally. As the Internal Revenue Service IRS. For a confidential consultation with an experienced child custody lawyer in Dallas.

To claim the child care tax credit the child must spend more than 50 of their time with you. Typically the parent who has custody of the child for more. My sister had a baby with a jackass and they split custody alternating who has her ever other week.

Who Claims a Child on Taxes With 5050 Custody. Thats because people who co-parent closely must get along well. Typically when parents share 5050 custody they alternate.

November 25 2019 Child Custody. Following a divorce or separation parents need to determine who will claim their children on their taxes. Call 303-832-4200 or contact us online for a confidential no-obligation consultation.

The IRS has put rules in place to make tax filing fair for parents who have 5050 custody. Only one parent can claim a child per year. So one parent claims for the child.

FAQs About Tax Deductions With Joint. Who claims child on taxes with a 5050 custody split. In cases where custody is split exactly 5050 the parent with the highest income gets the benefit explains Hoppe.

In our experience judges in Cherokee County are less willing to order 5050 joint custody if the divorce was contentious. Usually this amount can be claimed by either parent. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents.

Having a child may entitle you to certain deductions and credits on your yearly tax return. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the. The Internal Revenue Service IRS typically.

The custodial parent as defined by the IRS claims the child tax credit in a 5050 division.

Georgia Divorce Guide Lawsuit Org

Can My Ex Claim My Children On Taxes New Beginnings Family Law

Who Claims The Child On Taxes With 50 50 Custody Denver Co

Georgia Custody And Visitation Schedule Guidelines Ga

Who Claims The Child On Taxes With 50 50 Custody Denver Co

How You Can Beat Child Custody Laws In Georgia The Hive Law

Who Claims A Child On Us Taxes With 50 50 Custody

The Basics Of Visitation Violations In Georgia Andersen Tate Carr P C

5 2 2 5 Parenting Schedule Joint Physical Custody Williams Divorce

Custody Does Matter When Filing Your Taxes 2020 Update Andalman Flynn Law Firm

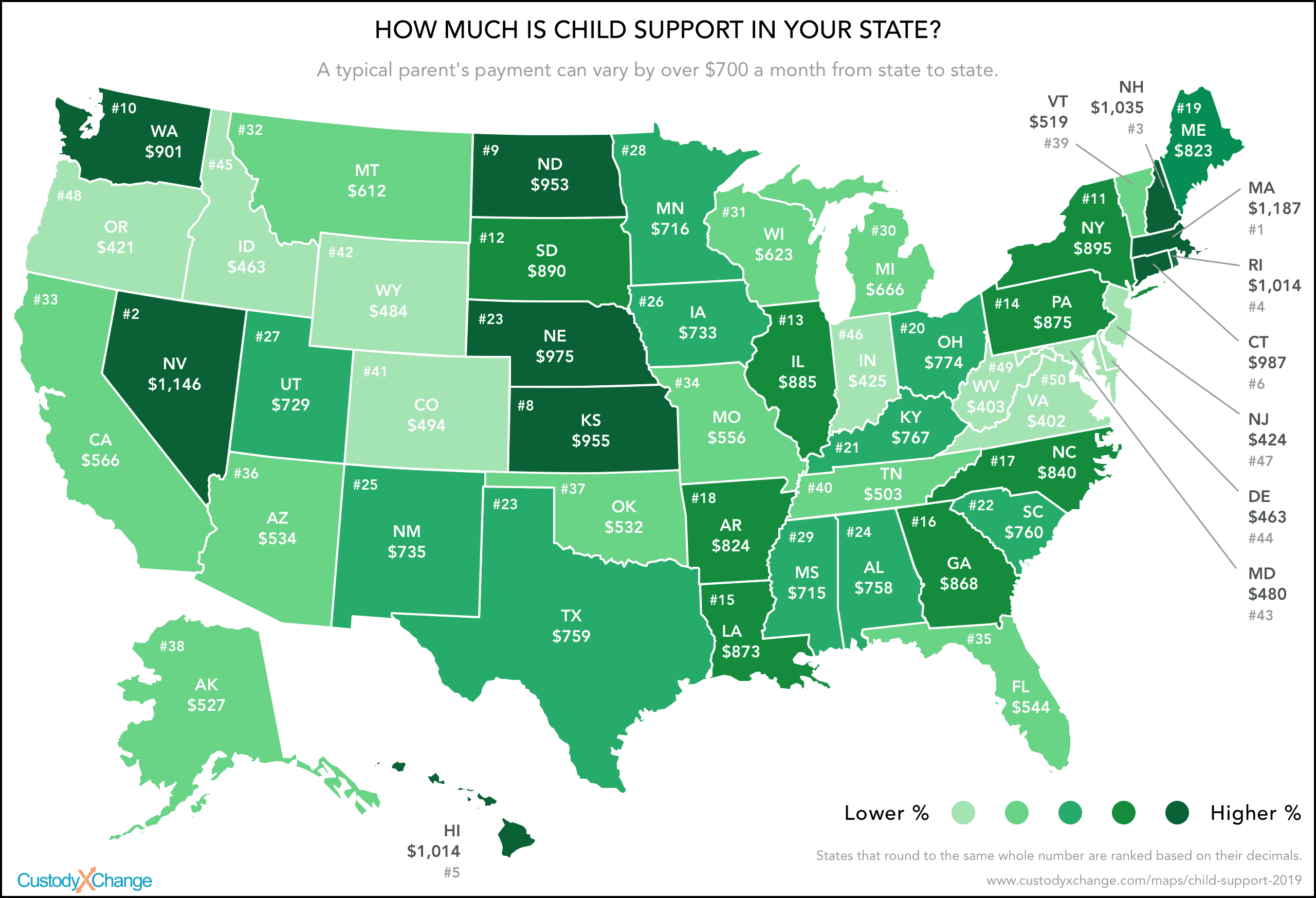

How Much Is Child Support In Your State Custody X Change

Child Custody Parenting Time Faqs In New Jersey Weinberger Divorce Family Law Group

Who Claims A Child On Taxes With 50 50 Custody Smartasset

Lagrange Child Support Lawyer Moffitt Law Llc

What Happens When Both Parents Claim A Child On A Tax Return Turbotax Tax Tips Videos

Child Custody Statistics What Custodial Parents Should Know

Who Claims The Child On Taxes With 50 50 Custody Denver Co

Co Parenting How Child Support And Shared Custody Affect Your Taxes The Official Blog Of Taxslayer